Calculation of the average number of teachers program 1s

Not later than January 20, 2017, information on the average headcount for 2016 must be submitted to the tax inspectorate on a form in the form with the KND code 1110018. Recommendations on how to fill out the form “Information on the average headcount for the previous year” are given in the letter of the Federal Tax Service of the Russian Federation No. 6-25/ dated April 26, 2007. The indicator of the average headcount is calculated according to the rules of Rosstat (Instructions approved by order No. 498 dated October 26, 2015). In the program "1C: Payroll and HR 8" ed.3, in accordance with these requirements, you can get the value of the average headcount (Fig. 1) for the previous year in the report of the same name (Fig. 2). Fig.1 Fig.2 For the correct calculation of the average headcount, the program must contain all documents registering working hours and the time of absence of employees from the workplace.

Information on the average number of employees

This is man-days per month for part-time employees.

- Man-days must be divided by the working days of the month. For example, an employee of an enterprise works 6 hours a day, another - 5 hours. February 2018 has 18 business days. They worked 198 hours: (6*18 + 5*18).

The number of man-days for a 40-hour week in February was: 198 / 8 = 24.75. 24.75 / 18 = 1.375, after rounding up, we get 1 - the TFR of two part-time employees in February. If the employer employs both full-time and part-time employees, then the NFR for the year is equal to the sum of their monthly NVRs separately, divided by 12 and rounded to the nearest whole number. To automatically determine the HFR, you can use the online calculator of the personnel or salary system, for example, 1C: Entrepreneur. The table will help determine the length of the working day: Duration of the week, h.

Secrets of "1s:zup": how to calculate the average headcount

The report can also be submitted electronically by sending it via electronic communication channels. To do this, you must conclude an agreement with a specialized company. She will install the program and issue an electronic digital signature.

Important

The taxpayer has the right to use a paid service for sending the calculation. It is provided by companies dealing with this issue. When registering or reorganizing, LLCs are required to provide the calculation of the CFR to the tax office.

This must be done by the 20th day of the month following the change. An individual entrepreneur submits information at closing no later than the day the entrepreneur is actually removed from tax records. Responsibility A certificate of the SHR is submitted to the tax office for verification and further processing.

In case of delay or non-submission of the report, administrative sanctions are applied to the organization. Their list is indicated in the table: Culprit Punishment Jur. person, unintentional failure to present 200 rub. for each document Jur.

Average headcount in 1s 8.3 (8.2)

If the whole year is worked out, then the NFR is equal to the sum of the NFR for the months divided by 12. If the year is not fully worked out, the calculation is made similarly to the algorithm for an incomplete month. In this case, the denominator of the fraction is also equal to 12. Similarly, the SFR is determined for any other interval.

So, for a quarter, the indicator is equal to the sum of the headcount for each month of the period divided by 3. When finding the value for six months or 9 months, the amount received in the numerator is divided by 6 and 9, respectively. Incomplete time In accordance with paragraph 81.3 of the Instructions, employees who have not fully worked for a period are subject to accounting in proportion to the time they spent on work.

To do this, follow these steps:

- Determine the number of man-hours worked by staff on an incomplete schedule.

- The result is divided by the length of the working day according to the norm.

Online calculator for calculating the average number of employees

What is not included in the calculation of the average headcount for the year What is included and what is not The instructions of Rosstat (Order No. 428 of 10/28/13) state that the average headcount includes all persons hired under an employment agreement, as well as founders receiving a salary. The data of paragraphs 79-81 of the document are reflected in the form of a table: Persons included in the SCR Persons not included in the SCR

- who got a job, but did not start their duties due to any internal problems in the company;

- traveled on business trips;

- not working due to illness (sick leave required);

- on probation;

- working at home;

- enrolled in a university or improving their qualifications while maintaining their salary;

- working temporarily;

- on vacation, incl.

Calculation of the average number of teaching staff

Sometimes HR workers have a question, how to calculate the average number of employees for the quarter? This indicator is determined by summing up the average number of employees for all months of the organization's work in the quarter and dividing the resulting amount by three. The average number of employees for the period from the beginning of the year to the reporting month inclusive is determined by summing up the average number of employees for all months that have elapsed for the period from the beginning of the year to the reporting month inclusive, and dividing the amount received by the number of months for the period from the beginning of the year. To quickly and accurately calculate the indicators of payroll and average headcount, use HR automation programs. For example, the Kontur-Personnel program calculates indicators for any date and for any period, while taking into account all of the above rules.

The procedure for calculating the average number of employees

Attention

In this case, the NFR for each month of work is summed up and divided by 12. How to calculate the average number of employees per month The NFR for each day is summed up and divided by the sum of the days of the month (including holidays and weekends). The resulting value is rounded to integers and we get the TFR for the month.

For example, the number of employees in January: CFR for January = 388 / 31 calendar days = 12.52 = 13. Calculation of the average headcount in 1C 8.3 (8.2) ZUP 3.0 and ZUP 2.5 In salary programs 1C 8.3 (8.2) ZUP 3.0 and ZUP 2.5 the calculation of the headcount is automatic, taking into account the number of rates, taking into account possible periods that are not taken into account in the average headcount. However, there are nuances that are not automated in 1C 8.3 (8.2) salary programs.

The number of employees for a weekend or public holiday is considered equal to the headcount for the previous working day.

Filling order

There are two categories of workers who are included in the headcount, but excluded from the calculation of the CHR. These include women on maternity leave, maternity leave, and individuals who have taken additional unpaid leave to enroll in an educational institution or continue their studies. An example of calculating the CHR for a month. At the end of October, the SCR is 14 people, in November, on the 12th, 5 were hired, and on the 28th, 7 were fired.

So:

- from 1 to 11 - 14;

- from 12 to 27 - 19;

- from 28 to 30 - 12.

NFR for November = (11*14 = 154) + (16*19 = 304) + (3*12 = 36) / 30 = 16.47, i.e. a total of 16 people. If the company did not start working from the beginning of the month, then the CFR is found by dividing the number of employees for the worked interval by the total number of days of the month. Reporting period Enterprises report to the tax authorities once a year, and to off-budget funds quarterly.

Number of employees: payroll and average payroll

Reply with quote Up ▲

- 07/02/2013, 17:03 #6 Posted by Anonymous64 without half a liter you can’t figure it out, that is, without options or something to somehow fix the situation?

- 07/05/2013, 12:41 #7 Tell me: are people on maternity leave and parental leave included in the number when calculating the limit of 100 employees when using UTII and STS? Reply with quote Up ▲

- 07/05/2013, 14:01 #8 in the document, which reflects parental leave, there should be a sign “to release a staff unit” 1. A new radio station for users called RT FM has been opened. It will broadcast readings of various manuals and answers to frequently asked questions.2.

In the payroll as of June 30, he is included as 0 (since he no longer works in the organization as of June 30). It is included in the average headcount for June as: (1 * 20) / 30 = 0.67 The main employee with part-time work established by agreement of the parties (Article 93 of the Labor Code of the Russian Federation) Integer units x / y x - the number of hours worked by the employee per month (with in this case, for days of illness, vacation and other absences falling on working days, the hours of the previous working day are conditionally included in the number of man-hours worked); y - the number of working hours in a month according to the standard work schedule Let's say an employee who is on parental leave went on a part-time job for a 5-day schedule with a 6-hour working day instead of an 8-hour one.

For example, if an employee at the main place of work is listed on a part-time basis, then he is considered as ½ employee. If an employee is listed at 1.5 rates, then he is taken into account in the calculation as 1. How to calculate the average headcount in an organization for the year to the regulatory authorities. However, this indicator is statistical and a certain error may be present. The average number of employees (AHR) in the organization for the year is calculated by summing the average number of employees of each month of the reporting year, and then dividing the total by 12: Dividing by 12 is always done, even if the organization was registered in the middle of the year, and works, for example, for six months .

Information on the average number of employees

Attention

The rules for calculating payroll and average headcount were approved by Rosstat Order No. 428 dated October 28, 2013. Together with Anastasia LOZHNIKOVA, project manager, Kontur-Personnel, we will consider in more detail how to perform calculations in both cases.

How to calculate the headcount of employees? The list of employees includes employees who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more, as well as working owners of organizations who received wages in this organization. The headcount is calculated on a specific date.

It includes whole units, both actually working and absent from work for any reason.

Secrets of "1s:zup": how to calculate the average headcount

- 07/02/2013, 08:19 #2 You can! Easily!!! Message from Kotoobekt Hello! Is there any way to see how the program calculates the average headcount? For some reason, a girl on parental leave also falls into this indicator. Thank you in advance) Run the Configurator, open this report / processing, go to the module, set a breakpoint in the right place and start the Enterprise in debug mode! All…

Average headcount in 1s 8.3 (8.2)

Most organizations, especially large ones, use an automated personnel accounting system to count the number. On its basis, programs have been created that independently calculate the necessary indicators, which are then entered into the report.

For example, this can be done in 1C 8.2 ZUP. The initial data of the NFR are calculated on the basis of the daily accounting of the number of employees. The number according to the lists must correspond to the data of the time sheets of forms T-12 and T-13.

The headcount includes contracted employees, including salaried founders. The length of the agreement does not matter. Persons who have worked only one day are also taken into account.

Both employees who appeared at work and those who are absent for certain reasons are taken into account.

Online calculator for calculating the average number of employees

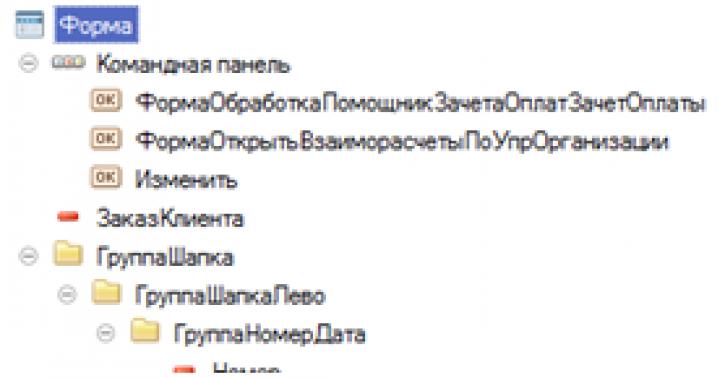

The calculation of the average headcount in the program 1C 8.3 ZUP 3.0 The calculation of the average headcount in the program 1C 8.3 ZUP 3.0 is fully automatic and is carried out through the Menu - Personnel report - Average headcount - Generate: Setting in 1C 8.3 for personnel 3.0 of this report is the default summary: How to calculate the average headcount of employees in 1C 8.3 Accounting 3.0 Menu Reports - Scheduled reports: Create a new report: Select Other reporting - Information about the average headcount: Select an organization, indicate the reporting period, click Create: By clicking the Fill button in 1C 8.3, a report is generated automatically: Program 1C 8.3 generates an average payroll number of employees: In 1C 8.3 Accounting 3.0, personnel records are kept for the hiring and dismissal of employees, respectively, the 1C 8.3 program can form the average number of employees.

Calculation of the average number of teaching staff

Where to submit Calculations on the SFR are submitted to the tax office at the place of registration of the taxpayer. Form KND 1110018 is filled in by the head or an authorized employee.

Important

They should know what is included in the calculation, with the exception of items intended for tax marks. Two copies should be made. One for the Federal Tax Service, the second, with a mark of acceptance, for filing with the organization's annual reporting.

If the enterprise has separate subdivisions, a separate calculation is provided for them. The form can be obtained from the tax office or independently found on the Internet and downloaded.

At the same time, attention should be paid to its relevance. It is convenient to use online services to prepare the calculation.

The procedure for calculating the average number of employees

Every day, for each worker, the number of hours worked is reflected and symbols are put down. The main indicators include the following: I Work during the daytime.

H Work at night. C Overtime work. To business trip. OT Basic vacation. R Maternity leave.

B sick leave. NN Absence for an unexplained reason. Based on the information from the report card, the SHR is calculated for the month.

Timing variations The procedure for calculating the NFR will differ depending on the period for which it is determined. Month The following formula is used to calculate the monthly PFR: Monthly PFR = PFR of full-time workers in the month + PFR of part-time workers. The number of full-time employees is equal to the sum of the payroll for each day of the month divided by the number of days in the month. TFR for weekends and holidays is taken according to the data of the previous working day.

Filling order

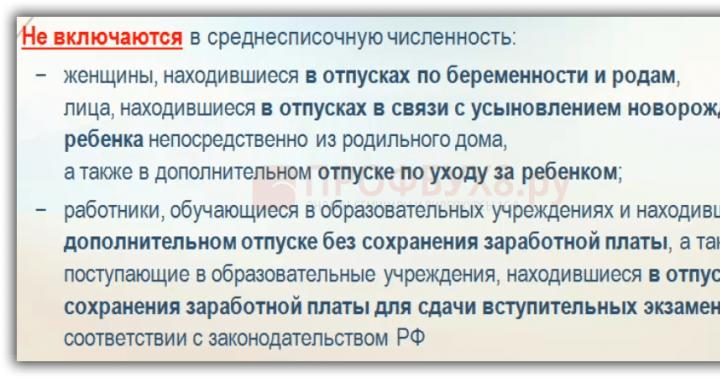

The procedure for calculating the average number of employees In the general case, the average number of employees per month is calculated by summing the number of employees on the payroll for each calendar day of the month, including holidays (non-working) and weekends, and dividing the amount received by the number of calendar days of the month. In this case, the number of employees on the payroll for a day off or a holiday (non-working) day is taken equal to the payroll number of employees for the previous working day. However, there are some exceptions to the general counting rule, which are listed in detail in paragraph 81 of the order. So, for example, the average headcount does not include employees who are on maternity leave, childcare leave (clause 81.1). In addition, employees working part-time (in accordance with Art.

Number of employees: payroll and average payroll

Labor Code of the Russian Federation), are taken into account in proportion to the hours worked. But at the same time, if part-time work is established at the initiative of the employer (in accordance with Art.

74 of the Labor Code of the Russian Federation) or a reduced working time for an employee is established by law (for example, disabled people of groups I and II, as well as other categories of workers in accordance with Article 92 of the Labor Code of the Russian Federation), such employees are taken into account in the average headcount according to the general rule. Consider the scheme for calculating the average headcount for the most frequent cases: Type of employee Accounting in the headcount Accounting in the average headcount Example Main employee with a full time Integer units (1 * n) / m n - the number of calendar days worked by the employee in a month; m - the number of calendar days of the month The employee leaves from June 20th.

Penalties are provided for failure to provide information on the average number of employees: for an organization (IP) - 200 rubles, and for the head of the organization - from 300 to 500 rubles. What is the difference between average and median? Average is a fairly broad term.

The average includes:

- regular workers,

- external part-time workers who work at their main place of work in another organization,

- employees under civil law contracts (GPC):

The average number of employees is the number of payroll without external part-time workers and employees under GPC agreements. It is necessary to submit data to the IFTS on the average number of employees.

Information on the average headcount is annually submitted to the regulatory authorities. The format of the report is reflected in the Order of the Federal Tax Service dated March 29, 2007 No. MM-3-25 / 174. Recommendations on the filling rules are reflected in the Letter of the Federal Tax Service of April 26, 2007 No. ChD-6-25 / 353. If the average number of employees at the enterprise is more than 100 people, then information is submitted via electronic communication channels.

By virtue of paragraph 3, clause 3, article 80 of the Tax Code of the Russian Federation (as amended by the Federal Law of July 23, 2013 No. 248), information on the average number of employees for the previous year is submitted by all taxpayers, even if there are no employees. Information may not be submitted by individual entrepreneurs without employees. However, individual entrepreneurs who attracted employees during the reporting period hand over this information. Newly created organizations also provide information no later than the 20th day of the next month for which they were created.

The report on the average headcount is submitted only by the parent organization, including for separate divisions.

Penalties are provided for failure to provide information on the average number of employees: for an organization (IP) - 200 rubles, and for the head of the organization - from 300 to 500 rubles.

What is the difference between average and median?

Average is a fairly broad concept. The average includes:

- regular workers,

- external part-time workers who work at their main place of work in another organization,

- employees under civil law contracts (GPC):

The average number of employees is the number of payroll without external part-time workers and employees under GPC agreements. It is necessary to submit data to the IFTS on the average number of employees.

Calculation of the average number of employees

Features of calculating the average headcount

The average headcount does not include:

The owner of the organization is not reflected in the average headcount if he does not receive income in this organization, that is, he is listed as the only founder without paying a salary. If the owner of the organization works as a director and receives a salary, then it is taken into account in the calculation.

Persons who have worked part-time when calculating the NFR are taken into account depending on the amount of time worked. We talk in more detail about part-time work in 1C 8.3 on the course. At the same time, there is the concept of part-time work and reduced working time, in this case the first is taken into account.

Part-time work in 1C programs is calculated in proportion to the number of positions taken. For example, if an employee at the main place of work is listed on a part-time basis, then he is considered as ½ employee. If an employee is listed at 1.5 rates, then he is taken into account in the calculation as 1.

How to calculate the average headcount in an organization for the year

The indicator of the average headcount is very important, as it can affect the possibility of applying special tax regimes, the form in which reports can be submitted to regulatory authorities. However, this indicator is statistical and a certain error may be present.

The average number of employees (AHR) in the organization for the year is calculated by summing the average number of employees for each month of the reporting year, and then dividing the total by 12:

Dividing by 12 is always done, even if the organization was registered in the middle of the year and has been operating, for example, for six months. In this case, the HFR for each month of work is summed up and divided by 12.

How to calculate the average number of employees per month

The TFR for each day is summed up and divided by the sum of the days of the month (including holidays and weekends). The resulting value is rounded to integers and we get the TFR for the month.

For example, the number of employees in January:

January HFR = 388/31 calendar days = 12.52 = 13.

Calculation of the average headcount in 1C 8.3 (8.2) ZUP 3.0 and ZUP 2.5

In the salary programs 1C 8.3 (8.2) ZUP 3.0 and ZUP 2.5, the calculation of the headcount is automatic, taking into account the number of rates, taking into account possible periods that are not taken into account in the average headcount. However, there are nuances that are not automated in 1C 8.3 (8.2) salary programs.

The number of employees for a weekend or public holiday is considered equal to the headcount for the previous working day.

For example, on December 31, an employee quit, respectively, on December 31, he was included in the payroll as 1. Accordingly, according to the rules, this employee is taken into account in the payroll and during the New Year holidays. However, in the salary programs 1C 8.3 (8.2), a dismissed employee during the New Year holidays is not taken into account when calculating the number.

Calculation of the average headcount in the program 1C 8.2 ZUP 2.5

Menu Payroll for organizations - Reports - Scheduled reports. We create a new report - Other reporting - Information about the average headcount - Fill in. SHR is calculated automatically:

It is possible to check the correctness of filling using the report Menu HR records - Average number of employees:

Calculation of the average headcount in the program 1C 8.3 ZUP 3.0

The calculation of the average headcount in the program 1C 8.3 ZUP 3.0 is fully automatic and is carried out through the Menu - Personnel report - Average headcount - Generate:

The default setting in 1C 8.3 for frames 3.0 of this report is summary:

How to calculate the average number of employees in 1C 8.3 Accounting 3.0

Menu Reports - Scheduled reports:

Create a new report:

We select Other reporting - Information on the average headcount:

Select an organization, specify the reporting period, click Create:

By clicking the Fill button in 1C 8.3, a report is automatically generated:

Program 1C 8.3 generates the average number of employees:

In 1C 8.3 Accounting 3.0, personnel is maintained and, accordingly, the 1C 8.3 program can form the average headcount. However, 1C 8.3 Accounting 3.0 does not take into account the time spent by employees on maternity leave, parental leave, educational unpaid leave. In addition, in 1C 8.3 Accounting 3.0, the number of positions taken by an employee is not fixed. Therefore, in 1C 8.3 Accounting 3.0 generates an approximate calculation of the number of employees, and in certain cases, manual calculation and adjustment may be required.

How to check the calculation of the average headcount from 1C 8.3 (8.2)

To check the calculation of the average headcount from 1C 8.3 (8.2) for a month, you need to compile a table where you can calculate the number of employees by day and subtract employees that are not included in the average headcount:

Or make another table, where for each employee calculate the amount of days worked and subtract the period that should not be included in the calculation of the average headcount:

Both in the first and in the second table the result will be the same. The average number in our example for January = 388. We divide by 31 calendars. day = 12.52. Round up to a whole number = 13.

Divide the total amount by 12. From the example of the TSC for 2015 = 162÷12 = 13.5. Round up to a whole number =14.

Let's consider another example, where the organization worked only 3 months in the current year. Date of registration 01.10.2015:

AMS for 2015 = 30÷12 = 2.5. Round up to a whole number =3.

On the PROFBUH8 website you can see our other free articles and materials on configurations:

1C:Accounting