Step 1. Settings for accounting for imported goods according to customs declaration

It is necessary to configure the functionality of 1C 8.3 through the menu: Home- Settings- Functionality:

Go to bookmark Stocks and check the box imported goods. After installing it in 1C 8.3, it will be possible to keep records of consignments of imported goods according to the numbers of customs declarations. In the receipt and sale documents, the details of the customs declaration and the country of origin will be available:

To make settlements in currency, on the Settlements tab, check the Settlements in currency and c.u. box:

Step 2. How to post imported goods in 1C 8.3 Accounting

Let's enter the document Receipt of goods in 1C 8.3 indicating the number of the customs declaration and the country of origin:

The movement of the receipt document will be as follows:

On the debit of the auxiliary off-balance sheet account GTD information on the quantity of imported goods received, indicating the country of origin and the number of the customs declaration will be reflected. The balance sheet for this account will show the balances and movement of goods in the context of the customs declaration.

When selling imported goods, it is possible to control the availability of goods moved by each customs declaration:

In the program 1C 8.3 Accounting on the Taxi interface for accounting for imports from member countries customs union changes were made to the chart of accounts and new documents appeared. See our video for more on this:

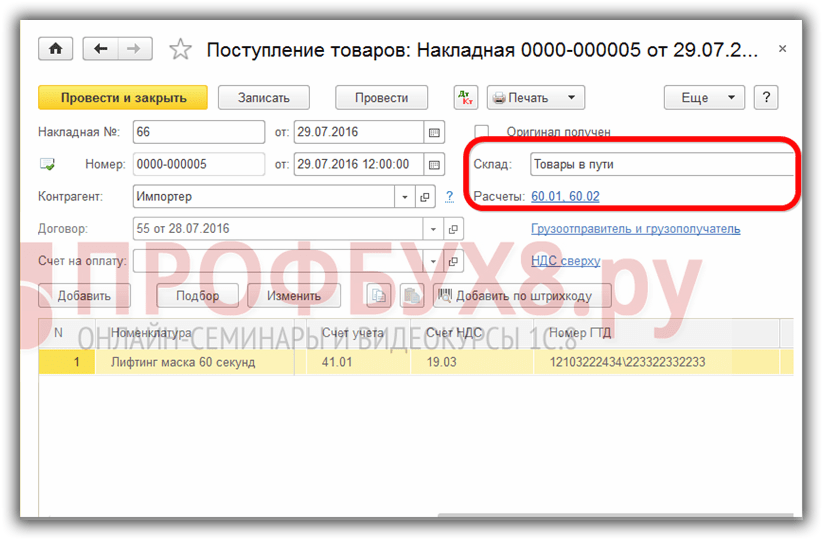

Step 3: How to account for imported goods as goods in transit

If during the delivery period it is necessary to consider imported goods as material assets that are in transit, you can create an additional warehouse to account for such goods as a warehouse Items are on their way:

Account 41 analytics can be configured by storage locations:

To do this, in 1C 8.3 you need to make the settings:

Click on the link Accounting for inventory and check the box Warehouses (storage places). This setting in 1C 8.3 makes it possible to enable storage location analytics and determine how accounting will be kept: only quantitative or quantitative-sum:

When the goods actually arrive, we use the following document to change the storage location:

Fill out the document:

The balance sheet for account 41 shows movements in warehouses:

Step 4. Filling out the customs declaration document for import in 1C 8.3

Enterprises that carry out direct deliveries of imported goods must reflect customs duties for the goods received. Document GTD for import in 1C 8.3 can be entered on the basis of the receipt document:

or from the Buy menu:

Let's fill out the customs declaration document for import in 1C 8.3 Accounting.

On the Main tab, specify:

- The customs authority to which we pay duties and the contract, respectively;

- According to what customs declaration number the goods arrived;

- Sum customs duty;

- The amount of fines, if any;

- Let's put up a flag Record the deduction in the purchase book, if you need to reflect it in the Purchase Book and automatically accept VAT for deduction:

On the tab Sections of the customs declaration, enter the amount of the fee. Since the document is generated on the basis, then 1C 8.3 has already filled in certain fields: customs value, quantity, batch document and invoice value. We will enter the amount of the duty or the rate of% duty, after which 1C 8.3 will distribute the amounts automatically:

Let's pass the document. We see that customs duties are charged to the cost of goods:

To study in more detail the features of posting goods in the event that a customs declaration is indicated in the supplier's invoice, check the registration of such an invoice in the Purchase Book, study the program 1C 8.3 on professional level with all the nuances of tax and accounting, from the correct input of documents to the formation of all basic reporting forms - we invite you to our. Learn more about the course in our video:

1. Payment to the supplier is made by the document "Debit from the current account" with the type of transaction "Payment to the supplier".

For example, on May 1, 2012, the USD exchange rate was 29.3627, respectively, if you pay 300 USD, the ruble equivalent will be 8,808.81 rubles. and the program will generate the postings:

2. At the time of the transfer of ownership of the goods in the program, it is necessary to create a document "Receipt of goods and services" from the importer, under the contract in foreign currency and without VAT.

Depending on the accounting policy adopted by the organization, the receipt of goods can be reflected using accounts 15.02 "Procurement and purchase of goods" and 16.02 "Deviation in the cost of goods" or without their use.

If the organization uses accounts 15.02 and 16.02, on the basis of the settlement documents of suppliers received by the organization, an entry is made on the debit of account 15.02 and the credit of the corresponding account (60, 71, 76, etc., depending on where the goods came from). In this case, the entry in the debit of account 15.02 and the credit of account 60 is made regardless of when the goods arrived at the organization - before or after receipt of the supplier's settlement documents.

The posting of goods actually received by the organization is reflected by an entry in the debit of account 41 "Goods" and the credit of account 15.02.

If the accounting policy does not provide for the use of the 15th account or the transfer of ownership occurs at the time the goods arrive directly at the buyer's warehouse, then account 41.01 should be used.

Consider the case when an organization uses account 15.02 to account for goods and the transfer of ownership of the goods occurs at the time of its clearance at customs, then the receipt document indicates account 15.02 as the accounting account, and the receipt is registered at a fictitious warehouse, for example, "Customs".

Previously, for account 15.02, it is necessary to add the “Nomenclature” subconto, if we do not need to see the balances on account 15.02 in the context of goods, but only collapsed, then this subconto can be negotiable:

For example, on 05/10/2012 the exchange rate was 29.8075 USD, part of the goods was paid at the rate of 05/01/2012 (29.3627), the remaining part of the goods (700 USD) should be valued at the exchange rate at the time of transfer of ownership.

Goods for 1,000 USD in ruble equivalent will be equal to 29,674.06 rubles. (300$*29.3627 +700$*29.8075) and the program will generate postings:

3. On the basis of this document, it is necessary to enter the document "Customs declaration on import", which shows the amount of customs duty, percentage or amount customs duty and the VAT rate paid at customs.

On the “Main” tab, the customs declaration number and the amount of the customs duty are indicated:

On the “Customs declaration sections” tab, the program automatically enters the customs value in USD (can be changed if necessary), the amount of duty and VAT are calculated in ruble equivalent based on the customs value at the exchange rate as of the date of the “Import customs declaration” document.

If several sections are specified in the GTD, then an additional section is added by clicking the "GTE Sections - Add" button. After specifying the duty rate and VAT using the "Distribute" button, the program distributes the amounts of duty and VAT in proportion to the amounts of goods in the tabular part of the CCD section.

On the tab "Accounts of settlements" you can change the account of settlements with customs:

On the VAT tab for reflection in the purchase book of the deduction, the corresponding flag is affixed:

When posting, the document will generate the following postings:

Note! If, for example, it is necessary to reflect the customs duty and customs duty on the account where the goods are recorded (15.02 or 41.01), and on the cost account (44.01 or 91.02), then in this case, in the document “Customs declaration on imports”, you can manually change the accounting account on the tab “ Sections of the GTD", write down the document, close and reopen specify required article costs or types of other expenses and income:

4. If the transfer of ownership occurred at the customs, then after the goods arrive at the warehouse of our organization, it will be necessary to draw up the document “Operation (accounting and tax accounting)”. The data for filling it out can be obtained from standard reports, for example, the balance sheet for account 15.02 grouped by item:

Because on account 15.02, quantitative records are not kept, then the data on the quantity can be viewed from the receipt documents.

The document "Operation (accounting and tax accounting)" will look like:

Account 41.01 is indicated as account Dt. Subconto Dt1 - the name of the goods received.

As a batch document (SubcontoDt2) for all imported goods received under one document, you must select one (!) document "Batch (manual accounting)". For the first product from the list, you need to use the button "New batch document (manual accounting)" to create a document in which to fill in the "Counterparty" and "Agreement" fields with data on the importing supplier.

For all subsequent goods, the same document must be selected as the batch document using the "Select" button.

In the "SubcontoDt3" field, the warehouse to which the goods are received is indicated. In the "Quantity Dt" field, the amount of the goods received is indicated.

Account Kt - 15.02, because only the “Nomenclature” analytics (reverse subconto) was added to this account, then SubkontoKt1 is selected for incoming goods, or this field can generally be left empty. In the amount field, indicate the ruble value of the goods received, taking into account all additional expenses (based on the SALT).

The article will tell you how to correctly use a typical configuration in order to account for goods purchased on the territory of foreign countries. The technique is equally easy to use by both trade automation specialists and ordinary users.

Let us consider in detail the reflection of the operation of importing goods in the program “1C: Trade Management, ed. 10.3".

Creating a foreign supplier in 1C

When buying goods from foreign suppliers, there are some features when creating a counterparty and an agreement. Let's create a "Foreign Supplier" supplier in the "Counterparties" directory.

Menu: Directories - Counterparties (buyers and suppliers) - Counterparties

Add a counterparty, specify its name and set the "Supplier" flag. In addition to the "Supplier" flag, it is also desirable to put the "Non-resident" flag. In this case, the program will automatically issue documents from the supplier at the VAT rate "Without VAT":

Save the counterparty by clicking the "Save" button.

At the time of recording, the contract was automatically created for the counterparty. The contract must specify the currency, for example, Euro. Let's go to the "Accounts and agreements" tab, double-click to open the main agreement and change the currency:

Click the OK button to save and close the contract.

Currency bank account

For settlements with a foreign supplier, most likely, a currency other than the ruble will be used (in our example, the Euro). It is forbidden to make payments from a ruble account in foreign currency in the program, therefore, a separate foreign currency account must be available for payment. If it is not yet in the program, then you need to add it in the "Bank accounts" directory.

It is most convenient to open a list of bank accounts from the list of organizations form by clicking on:

Menu item: Go - Bank Accounts

Placing an order with a foreign supplier

When working with a foreign supplier, you can place an order, or you can work without an order. In this import is no different from buying from a Russian supplier. Place an order with a supplier for goods.

Menu: Documents - Purchasing - Orders to suppliers

In the document, we indicate the supplier, warehouse, ordered goods and their cost. Please note that the document is drawn up in the Euro currency and the VAT rate for all goods is set to “Without VAT”.

An example of a placed order:

Important: all imported goods must have the "Keep record by series" flag. Otherwise, it will not be possible to properly process the receipt of goods at the warehouse in the future.

Receipt of goods to the warehouse

At the time of receipt of goods at the warehouse, the document "Receipt of goods and services" is created.

Menu: Documents - Procurement - Receipts of goods and services

You can issue a document manually or on the basis of an order. We will make the receipt of goods based on the order to the supplier. The document will be filled in: the supplier, goods, cost are indicated.

Additionally, in the document, you must specify the number of the customs declaration of the goods received in the series field. Each series of goods is a combination of the customs declaration number and the country of origin.

To fill in a series of goods, click on the selection button in the "Nomenclature" field and add a new element in the "Series" directory that opens. In the nomenclature series, we select the country of origin of the goods and the customs declaration number:

Note: GTD numbers are stored in the directory. Do not enter new number GTD into the name of the series from the keyboard - this will cause an error. You need to go to the directory of CCD numbers, by clicking the selection button in the "Customer declaration number" attribute, and create a new number there or select one of the existing ones from the list.

The name in the series was generated automatically, you can save the series and select it in the document for the product:

Product series can be filled in immediately for all products from the document. To do this, click the "Edit" button above the products table. In the "Processing the tabular section" window that opens, select the action "Set series by customs declaration", specify the customs declaration number and country of origin:

Now the document is completely filled, you can swipe it and close it.

In this case, you do not need to enter an invoice.

Registration of customs declaration for import

For imported goods, customs clearance and customs clearance for imports are required. The database has a corresponding document reflecting the presence of a gas turbine engine.

Menu: Documents - Procurement - CCD for imports

It is most convenient to enter a document based on the receipt of goods and services, so as not to refill the supplier, warehouse and list of goods.

Based on the receipt of goods, we will create the document "Customs declaration for imports". The document must indicate the counterparty-customs and two contracts with customs: one in rubles, and the second in the currency of receipt of goods.

In the counterparty, it is not necessary to put down the flags "Buyer" or "Supplier", other mutual settlements are carried out with customs:

Agreements with customs:

Customs declaration for import:

On the tab "Sections of the customs declaration" information about goods and customs duties is indicated.

For ease of entry, the amounts can be displayed in foreign currency and in rubles - this is regulated by the flags "Customs value in rubles", "Duty in currency" and "VAT in currency".

We indicate the duty rate - 10%, the program automatically calculates the amount of duty and the amount of VAT based on the customs value:

After calculating the total duty and the amount of VAT, you need to distribute them among the goods using the "Distribute" button:

The document is completely filled, it can be held and closed.

Often, when working with imported goods, certificates of conformity are required. Additional module printing of the register of certificates of conformity will help you organize convenient storage and access to printed forms of documents at any time when you need it, without sorting through a pile of documents on your shelves.

Registration of additional costs for goods

Cost of imported goods

The cost of imported goods consists of the supplier's price, customs costs and additional costs. You can estimate the cost of goods in the report "Statement of consignments of goods in warehouses".

Menu: Reports - Stocks (warehouse) - List of consignments of goods in warehouses

To find out what makes up the cost of goods, you can set up a report - add “Movement document (registrar)” to the grouping of lines.

An example of a generated report:

We see that the amounts of customs duties and fees are also included in the cost of goods.

Registration of customs declaration for imports before the receipt of goods

Sometimes there is a situation when the customs declaration for import has already been received, but the goods have not yet arrived at the warehouse. In this case, the documents are entered in the reverse order: first, the customs declaration for imports, then the receipt of goods.

This option in the program is not very convenient, since you have to enter and fill in the customs declaration for imports completely manually.

Moreover, in this situation, customs clearance for imports, the batch document is not indicated - the receipt of goods and services (it does not exist yet), therefore the amounts of customs duties and fees are not included in the cost of goods.

To adjust the cost of selling goods, a special document “Correction of the cost of writing off goods” is used.

Menu: Documents - Inventory (warehouse) - Adjustment of the cost of write-off of goods

The document is issued once a month.

Buyer's order for imported goods

The buyer's order for imported goods is no different from the order for other goods and is made using the "Buyer's order" document.

Menu: Documents - Sales - Customer Orders

We will place an order for the Mobil counterparty for 30 phones at a price of 5000 rubles:

Realization of imported goods

There is a small feature in the sale of imported goods - the customs declaration number and country of origin must be indicated in the sales documents. In order for this information to be displayed in printed forms, a series of goods must be filled in the sales document.

Based on the buyer's order, we will make the document "Sale of goods and services":

In some cases, the program fills in the product series automatically. For example, if this is the only product series. Therefore, the series in our document is already filled.

If automatic filling did not occur, then use the "Fill and post" button - the program will fill in the series of goods and post the document:

Let's post the invoice by clicking the "Post" button and open the printable by clicking the "Invoice" button:

AT printed form the customs declaration number and the country of origin of the goods are automatically displayed, which were indicated in the series of goods in the sale.

GTD for import in 1C. Posting of imported goods and its sale

The article will tell you how to correctly use a typical configuration in order to account for goods purchased on the territory of states. The technique is equally easy to use by both trade automation specialists and ordinary users.

Let us consider in detail the reflection of the operation of importing goods in the program “1C: Trade Management, ed. 10.3".

Creating a foreign supplier in 1C

When buying goods from foreign suppliers, there are some features when creating a counterparty and an agreement. Let's create a "Foreign Supplier" supplier in the "Counterparties" directory.

Menu: Directories - Counterparties (buyers and suppliers) - Counterparties

Add a counterparty, specify its name and set the "Supplier" flag. In addition to the "Supplier" flag, it is also desirable to put the "Non-resident" flag. In this case, the program will automatically draw up documents from the supplier at the VAT rate "Without VAT".

Save the counterparty by clicking the "Save" button.

At the time of recording, the contract was automatically created for the counterparty. In the contract you need, for example, Euro. Let's go to the "Accounts and agreements" tab, double-click to open the main agreement and change the currency.

Click the OK button to save and close the contract.

Foreign currency account

For with a foreign supplier, most likely, a currency other than the ruble will be used (in our example, the Euro). It is forbidden to make payments from a ruble account in foreign currency in the program, therefore, a separate foreign currency account must be available for payment. If it is not yet in the program, then you need to add it in the "Bank accounts" directory.

It is most convenient to open a list of bank accounts from the list of organizations by clicking on the menu item "Go - Bank accounts".

An example of filling out a currency account:

Registration to a foreign supplier

When working with a foreign supplier, you can place an order, or you can work without an order. In this import is no different from buying from a Russian supplier. Place an order with a supplier for goods.

Menu: Documents - Purchasing - Orders to suppliers

In the document, we indicate the supplier, warehouse, ordered goods and their cost. Please note that the document is drawn up in the Euro currency and the VAT rate for all goods is set to “Without VAT”.

An example of a placed order:

IMPORTANT: all imported goods must have the "Keep record by series" flag. Otherwise, it will be impossible in the future to correctly receive the goods at the warehouse.

Receipt of goods to the warehouse

At the time of receipt of goods at the warehouse, the document "Receipt of goods and services" is created.

Menu: Documents - Procurement - Receipts of goods and services

You can issue a document manually or on the basis of an order. We will make the receipt of goods based on the order to the supplier. The document will be filled in: the supplier, goods, cost are indicated.

Additionally, in the document, you must specify the number of the customs declaration of the goods received in the series field. Each series of goods is a combination of the customs declaration number and the country of origin.

To fill in a series of goods, click on the selection button in the "Nomenclature" field and add a new element in the "Series" directory that opens. In the nomenclature series, we select the country of origin of the goods and the number of the customs declaration.

Note: GTD numbers are stored in the directory. Do not enter a new GTD number into the series name from the keyboard - this will cause an error. You need to go to the directory of CCD numbers, by clicking the selection button in the props " GTD number» , and create a new number there or select one of the existing ones from the list.

The name in the series was generated automatically, you can save the series and select it in the document for the product:

Product series can be filled in immediately for all products from the document. To do this, click the "Edit" button above the products table. In the "Processing the tabular section" window that opens, select the action "Set series by customs declaration", specify the customs declaration number and country of origin:

Now the document is completely filled, you can swipe it and close it.

In this case, you do not need to enter an invoice.

Registration of customs declaration for import

For imported goods, the customs declaration for imports must be passed and executed. The database has a corresponding document reflecting the presence of a gas turbine engine.

Menu: Documents - Procurement - CCD for imports

It is most convenient to enter a document based on the receipt of goods and services, so as not to refill the supplier, warehouse and list of goods.

Based on the receipt of goods, we will create the document "Customs declaration for imports". The document must indicate the counterparty-customs and two contracts with customs: one in rubles, and the second in the currency of receipt of goods.

In the counterparty, it is not necessary to put down the flags "Buyer" or "Supplier", other mutual settlements are carried out with customs:

Agreements with customs:

Customs declaration for import:

On the tab "Sections of the customs declaration" information about goods and customs duties is indicated.

For ease of entry, amounts can be displayed in foreign currency and in rubles - this is regulated by the flags "Customs value in rubles", "Duty in currency" and "VAT in currency".

We indicate the duty rate - 10%, the program automatically calculates the amount of duty and the amount of VAT based on the customs value.

After calculating the total duty and the amount of VAT, you need to distribute them among the goods using the "Distribute" button:

The document is completely filled, it can be held and closed.

Often, when working with imported goods, compliance is required. An additional module for printing the register of conformity certificates will help you organize convenient storage and access to printed forms of documents at any time when you need it, without sorting through a pile of documents on your shelves.

Registration of additional costs for goods

Receipt of additional expenses for imported goods is processed in a standard way. More about the design of the add. expenses, see the article how to reflect additional. expenses in 1C

Cost of imported goods

The cost of imported goods consists of the supplier's price, customs costs and additional costs. You can estimate the cost of goods in the report "Statement of consignments of goods in warehouses".

Menu: Reports - Stocks (warehouse) - List of consignments of goods in warehouses

To find out what the cost of goods consists of, you can set up a report - add “Movement document (registrar)” to the grouping of lines.

An example of a generated report:

We see that the amounts of customs duties and are also included in the cost of goods.

Registration of customs declaration for imports before the receipt of goods

Sometimes there is a situation when the customs declaration for import has already been received, but the goods have not yet arrived at the warehouse. In this case, the documents are entered in the reverse order: first, the customs declaration for imports, then the receipt of goods.

This option in the program is not very convenient, since you have to enter and fill in the customs declaration for imports completely manually.

In addition, in this situation, at the time of registration of the CCD for imports, the batch document - the receipt of goods and services (it does not exist yet) is not indicated, therefore, the amounts of customs duties and fees do not fall into the cost of goods.

To adjust the cost of selling goods, a special document “Correction of the cost of writing off goods” is used.

Menu: Documents - Inventory (warehouse) - Adjustment of the cost of write-off of goods

The document is issued once a month.

Buyer's order for imported goods

The buyer's order for imported goods is no different from the order for other goods and is made using the "Buyer's order" document.

Menu: Documents - Sales - Customer Orders

We will place an order for the Mobil counterparty for 30 phones at a price of 5000 rubles:

Realization of imported goods

There is a small feature in the sale of imported goods - the customs declaration number and country of origin must be indicated in the sales documents. In order for this information to be displayed in printed forms, a series of goods must be filled in the sales document.

Based on the buyer's order, we will make the document "Sale of goods and services":

In some cases, the program fills in the product series automatically. For example, if this is the only product series. Therefore, the series in our document is already filled.

If automatic filling did not occur, then use the "Fill and post" button - the program will fill in the series of goods and post the document.

Let's post the invoice by clicking the "Post" button and open the printable by clicking the "Invoice" button:

The printed form automatically shows the customs declaration number and the country of origin of the goods, which were indicated in the series of goods in the sale.

In this step by step instructions we will consider the receipt of imported goods in the 1C 8.3 program (accounting) and the reflection in the accounting of the duty on the customs declaration (cargo customs declaration).

The procedure in 1C 8.3 is carried out by two documents - "Receipt of goods and services" and "Customs declaration for imports".

Registration of arrival of imported goods to the warehouse

The first step is to register the arrival of imported goods at the warehouse. Receipt is made using the document "Receipt of goods and services". We will not dwell on this operation in detail; you can read about this document in.

We only note the nuances of import receipts. It is necessary to specify GTD number and country of origin(You can enter these directories at the time of document creation):

After the receipt is issued, you can proceed to reflect the duty for the goods.

GTD for import in 1C 8.3

Registration of the duty of imported goods in 1C 8.3 is made out by filling out the document "Customs declaration on imports".

The easiest way is to enter it on the basis of a previously created posting document:

Get 267 1C video lessons for free:

Let's note the features of filling out the document. On the "Main" tab, you must specify:

- which customs office will pay the duty () and under which contract;

- by what customs declaration number the goods arrived;

- the amount of customs duty;

- if there are fines, their amount;

- check the box "Reflect deduction in the purchase book" if you want to automatically accept in the purchase book.

You will get something like this: